Click to play video

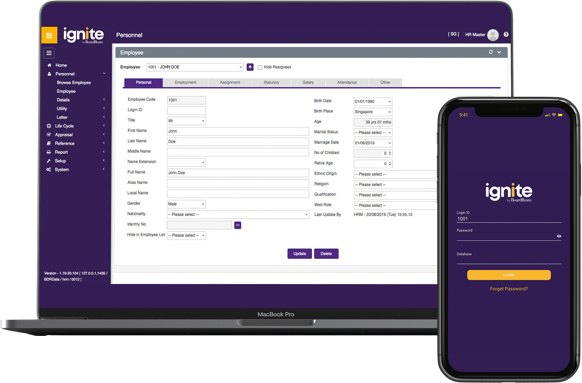

All the modules you need in one HR solution

Our all-in-one payroll platform delivers everything you need to empower your employees, reduce administrative burden and increase productivity.

We help you eliminate the need for multiple payroll systems. With unparalleled reporting capabilities and a true online multi-country payroll processing experience, Ignite is the only software your business needs as you expand in the region.

5 core modules for all your needs

Click the icons below to know more about each module

A comprehensive HRMS solution with multi-country statutory compliance and support, automating the entire payroll process and removing the need for manual calculations, enhancing both efficiency and accuracy.

A self-service portal offering an intuitive, multilingual interface and automated workflows to ease payroll administration. It includes an instant notification system to keep employees informed, allowing them to conveniently update their personal details online.

Managing leave has never been easier. Employees can quickly check their leave balance and seamlessly apply for annual, sick, maternity, or other types of leave, with the option to upload supporting documents. Employers can review and approve leave requests on the go, with the added convenience of preset automatic leave approvals.

Lower costs while enhancing visibility, efficiency, and transparency with our diverse attendance clocking technologies, shift calendar, and staff rostering system. Key features include timesheet imports from Excel and instant notifications for newly assigned shifts.

Claims applications, processing, and approvals can all be completed on the platform. Ignite also allows for the upload of supporting documents and capturing of receipts via mobile, offering convenience and flexibility.

Our core HR payroll software features

Our HR features make your life easier. Ignite offers a wealth of benefits to businesses looking for a robust and flexible payroll software.

Made for Mobility

Ignite helps your company stay connected 24/7 with our intuitive mobile app. Our cloud-based payroll solution provides instant access to payslips, claims and leave application.

Leave, Claims, Time & Attendance System

Reduce costs, increase visibility, efficiency and transparency with online leave and claims submission, attendance tracking and clocking technologies, shift calendar and staff rostering management system.

Employee Hub

A self-service HR portal with an intuitive multi-lingual user experience, Ignite automates workflows and reduces payroll administrative burden. A built-in instant notification system keeps your employees up-to-date on the latest happenings in workplace.

Payroll Processing Management

A complete HR payroll management solution with multi-country statutory support, Ignite automates your entire payroll process and eliminates the need for manual calculation, increasing efficiency and accuracy. Ignite’s reporting capabilities also easily generate in-depth reports that enables better business decision-making.

Security

Handling payroll requires processing vast amounts of personal data relating to your employees. Ignite is OSPAR and PDPA compliant with ISAE 3402 certification. Enjoy peace of mind with maximum data security and protection with our certified ISO 27001 data centres.

True multi-country payroll experience

With a single login, Ignite offers you payroll experience in 10 countries, with multi-lingual support to meet even the most complex payroll requirements.

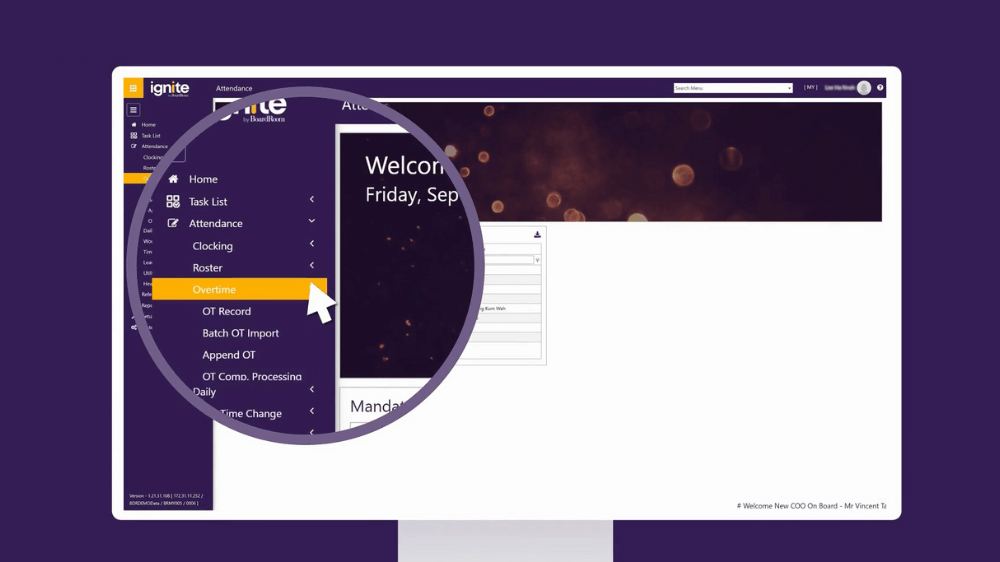

Experience the ease of use of Ignite’s capabilities

View our demo on how Ignite payroll software modules can help boost efficiency to your HR processing

Click to play video